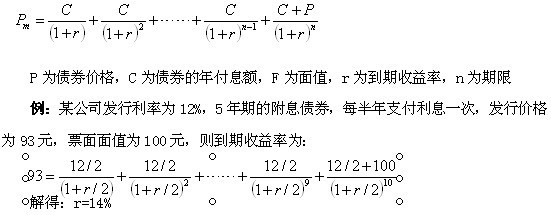

债券市场收益率是以市场价格换算出来的收益比率。例如债券票面价格为100元,当下的市场成交价若为90元,则市场收益率为10%。接下来小编为大家整理了市场收益率如何计算,希望对你有帮助哦!

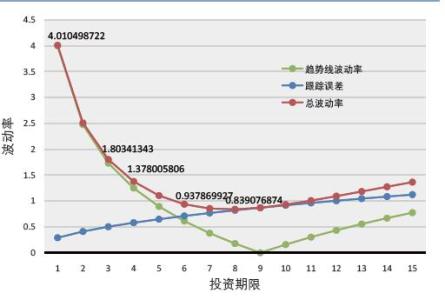

The stock market goes up and down. Suppose its level alternates each year between 50 and100, with no upward or downward trend. What is the capital return on the market?

股市有涨也有跌。假设每年的股价不是50就是100,没有上涨或下跌趋势。那么股市的资本回报率会有多大?

Common sense suggests the answer is zero. But is that common sense right? In the good yearsyou obtain a return of 100 per cent. In the bad, the yield is minus 50 per cent. The averagereturn is therefore 25 per cent. There is logic to that. If you invested the same amount everyyear, and sold at the end of a year, you would indeed make – on average – a very attractivereturn of 25 per cent a year.

根据常识,答案应该是零。但这一常识正确吗?在景气年份,你可以获得100%的回报率;在不景气年份,回报率则是负50%。因此平均收益率为25%。这是符合逻辑的。如果你每年都拿同样多的钱买股票,并在年末卖掉,那么平均算下来,实际上你每年会获得25%的回报率,这很有吸引力。

What if you bought and sold at random? In that case, four options are equally likely: buy andsell at 50, buy and sell at 100, buy at 50 and sell at 100, buy at 100 and sell at 50. Theoverall annual expected gain is 12.5 per cent.

如果你随意买卖,结果又会如何?在这种情况下,有四种同等概率的可能性:买卖价格都是50,买卖价格都是100,50买入100卖出,100买入50卖出。总体上,年预期回报率为12.5%。

If you are by now thoroughly confused, you are not alone. The average historic return on thevolatile equity market is central to calculations of the cost of capital and provision for futurepension liabilities. But the figure has been debated for decades. The dispute is less about theunderlying data than about the way you make the calculation. The question is often framedas the choice between arithmetic and geometric means.

如果现在你已经完全晕了,也属正常。波动性股市的平均历史回报率,是计算资金成本和未来养老金负债拨备的重要数据。但人们就这一数据已经争论了几十年。争论的焦点在于这一指标的计算方式,而不是原始数据。问题往往在于算数平均数和几何平均数之间的选择。

But there is no right or wrong answer. In all problems of this kind, the relevant measure isspecific to the particular purpose you have in mind.

但这个问题没有一个孰对孰错的答案。在所有这类问题中,方法与你心中特定的目的对应。

The way we measure inflation is, in principle, straightforward too.

总体来看,我们计算通胀的方式也非常简单。

You take an everyday basket of household goods and send a mystery shopper to discover whatthe bundle costs. Then you do the same thing a month later and find out how much the price ofthe basket has increased. You revise the composition of the basket regularly to introduce newgoods and eliminate obsolete ones, and to respond to changes in the composition ofspending.

你准备一篮子日常用品,然后让一个神秘的购物者去弄清这篮用品的成本。一个月之后做同样一件事,看看这篮用品的价格上涨了多少。你定期调整篮子里面东西的构成,增加新产品,去掉过时的产品,根据消费构成的变化而变化。

But every month some of the goods are on special offer. Perhaps you can buy one bottle ofshampoo and get one free. The price of shampoo has fallen by 50 per cent but you spend thesame and get two bottles. Then the offer ends, and the price has risen by 100 per cent.

但每个月都有一些产品打特价。比如说洗发水买一赠一,也就是说洗发水的价格降低了50%,或者说用同样的价格购买了两瓶。当特价结束的时候,价格又上涨了100%。

If you spent the same on shampoo and conditioner, and then the price of shampoo fell by half,and the price of conditioner doubled, we would probably want to say that the cost of washingyour hair has gone up.

如果洗发水和护发素的价格本来一样,然后洗发水的价格下降一半,护发素的价格翻番,或许我们就可以说洗头的成本上升了。

What happens in practice depends on the detail of the instructions to the mystery shopper andthe frequency with which the relative weights of the components of the basket are reassessed.

实际情况取决于这位神秘购物者得到的详细指令,以及篮子里各物品相对权重重新调整的频率。

爱华网

爱华网