存本取息定期储蓄是一种一次存入本金,分数次支取利息的定期储蓄、这种储蓄最适合那些一下子有整笔较大的款项收入,而在短时间之内又没有比较大的计划开支,将本金存入储蓄所,按时支取利息安排日常生活即可的人士。接下来小编为大家整理了什么是存本取息定期储蓄,希望对你有帮助哦!

Interest Withdrawal on principal deposited Time Deposit refers to savings deposit whose principal is deposited in a lump sum, whose interest is withdrawn by installment and whose principal is repaid upon maturity date. The minimum amount of the deposit is 5,000 RMB yuan and the maturities range from three grades: 1 year, 3 years and 5 years.

Service Features1.Interest Withdrawal on principal deposited Time Deposit has the characteristics of long maturity and high interest rate ,and suitable for depositing of savings that will not be used within a quite long period of time.

2.The savings office will issue a deposit certificate(passbook) to you and you will be paid the principal in a lump sum when the deposit is due. The deposit amount is set by the depositor and the accrued interests are paid by installment.

3.The interest is calculated at the same rate on time deposit in the deposit term. If there is no withdrawal upon maturity date, the interest, whose principal is post-dated, is calculated at the current deposit rate quoted on the day of withdrawal. If the depositor agrees, the bank can manage a promissory or an automatic renewal time deposit. Then the interest will be calculated at the rate quoted on the redeposit day.

Procedures for Account Opening1.In opening an account of Time deposit of small savings for lump-sum withdrawal, the depositor shall present his or her ID card or other valid credentials Chinese residents.

2.Such deposit may be withdrawn fully or partly prior to maturity for one time, or, upon authorization in advance, handled on agency renewal of depositing upon maturity by the bank.

3.At the time of account opening, the client may choose the method of withdrawal with a passbook or by password. If the method of withdrawal by password is chosen, the depositor shall enter on the spot a six-digit password into your savings account through the password processor on the counter.

存本取息定期储蓄存款是指一次存入本金,分次支取利息,到期支取本金,起存金额为5,000元人民币,存期分一年、三年、五年的一种储蓄存款。

业务特点1、存本取息定期储蓄存款具有期限长、利率高的特点,适用于较长时期不用的节余款项的存储。

2、由储蓄机构发给存款凭证,到期一次支取本金。存款金额由储户自定,分期支取本息。

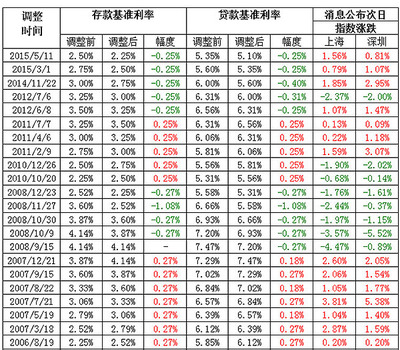

3、存期内按存入时同档次定期利率计息,到期未支取,超过存期部份按支取日公布的活期利率计息 。也可根据储户意愿,办理定期存款到期约定或自动转存,存款到期转存,按转存日挂牌公告的利率计息。

开户手续1、开立存本取息定期储蓄存款账户时,储户可凭其身份证或其他有效身份证件。

2、本存款可允许全部或部分提前支取一次,也可预约由银行代办到期转期续存。

3、开户时可选择凭密码取款或凭存折取款方式,如选择凭密码取款方式,储户须当场在柜台上的密码器上输入一个6位数字作为账户的密码。

爱华网

爱华网