特殊目的实体(SpecialPurpose Entity,简称SPE),在欧洲通常称为特殊目的载体(Special PurposeVehicle,简称SPV),是为了特殊目的而建立的法律实体,它在资产证券化中起到重要作用。

SPE是指由发起人建立、接受发起人的资产组合,并发行以此为支持的证券的特殊实体,其职能是购买、包装证券化资产和以此为基础发行资产化证券。建立SPE是证券化的中心环节。它的基本操作流程是从资产原始权益人(即发起人)处购买证券化资产,以自身名义发行资产支持证券进行融资,再将所募集到的资金用于偿还购买发起人基础资产的价款。

建立SPE是为了完成有限的、特殊的或临时的目标,主要是隔离金融风险(通常是破产风险,有时是具体的税收或管理风险)。一旦SPE成立,其必须作为一个完全独立的实体运作。这包括:委派其自己的董事,支付其自己的所有费用,不与其他实体的资产相混合(包括资产的卖方)。一旦资产转移给SPE,这些资产就被合法的隔离了,资产的卖方或债权人不能再处置资产。担保资产只能被用来支持向投资者发行的证券,而不能由卖方收回。投资者不想承担任何与资产卖方相关的风险。他们只愿意承担与其投资的特定证券化资产池相关的某种程度的风险。换言之,SPE对投资者形成保护,建立SPE或者向SPE出售资产的金融机构的破产或不良信用事件不会影响到投资者。

值得注意的是,SPE的建立是代表发起人的利益,但SPE并不归发起人所有。SPE必须在管理和所有权方面与发起人分离。例如,在一项贷款证券化中,如果SPE证券化载体归贷款银行(该银行的贷款将被证券化)所有或被银行控制,那么SPE将因规则、会计、破产等原因而与银行其他部分合并,这就违背了资产证券化的目的。因此,很多SPE作为单独的公司建立,其股份交给公益信托,由管理公司提供专业的管理人员,以确保SPE与发起人没有联系。作为独立的实体,SPE对自己的债券发行、风险资本和经营决策负责。许多SPE,如证券化SPE,是在事先确定好的指导方案下运作,不需要进行任何经营决策。

A special purpose entity (SPE; or, especially in Europe, specialpurpose vehicle/SPV, in Ireland – FVC financial vehiclecorporation) is a legal entity (usually a limited company of sometype or, sometimes, a limited partnership) created to fulfillnarrow, specific or temporary objectives. SPEs are typically usedby companies to isolate the firm from financial risk. A companywill transfer assets to the SPE for management or use the SPE tofinance a large project thereby achieving a narrow set of goalswithout putting the entire firm at risk. SPEs are also commonlyused in complex financings to separate different layers of equityinfusion. In addition, they are commonly used to own a single assetand associated permits and contract rights (such as an apartmentbuilding or a power plant), to allow for easier transfer of thatasset. Moreover, they are an integral part of public privatepartnerships common throughout Europe which rely on a projectfinance type structure.

A special purpose entity may be owned by one or more otherentities and certain jurisdictions may require ownership by certainparties in specific percentages. Often it is important that the SPEnot be owned by the entity on whose behalf the SPE is being set up(the sponsor). For example, in the context of a loansecuritization, if the SPE securitisation vehicle were owned orcontrolled by the bank whose loans were to be secured, the SPEwould be consolidated with the rest of the bank's group forregulatory, accounting, and bankruptcy purposes, which would defeatthe point of the securitisation. Therefore many SPEs are set up as'orphan' companies with their shares settled on charitable trustand with professional directors provided by an administrationcompany to ensure that there is no connection with the sponsor.

Uses

Some of the reasons for creating special purpose entitiesare:

Securitization: SPEs are commonly used to securitise loans (orother receivables). For example, a bank may wish to issue amortgage-backed security whose payments come from a pool of loans.However, to ensure that the holders of the mortgage-back securitieshave the first priority right to receive payments on the loans,these loans need to be legally separated from the other obligationsof the bank. This is done by creating an SPE, and then transferringthe loans from the bank to the SPE.

Risk sharing: Corporates may use SPEs to legally isolate a highrisk project/asset from the parent company and to allow otherinvestors to take a share of the risk.

Finance: Multi-tiered SPEs allow multiple tiers of investmentand debt.

Asset transfer: Many permits required to operate certain assets(such as power plants) are either non-transferable or difficult totransfer. By having an SPE own the asset and all the permits, theSPE can be sold as a self-contained package, rather than attemptingto assign over numerous permits.

For competitive reasons: For example, when Intel andHewlett-Packard started developing IA-64 (Itanium) processorarchitecture, they created a special purpose entity which owned theintellectual technology behind the processor. This was done toprevent competitors like AMD accessing the technology throughpre-existing licensing deals.

Establishment of a SPE

Like a company, an SPE must have promoter(s) or sponsor(s).Usually, a sponsoring corporation hives off assets or activitiesfrom the rest of the company into an SPE. This isolation of assetsis important for providing comfort to investors. The assets oractivities are distanced from the parent company, hence theperformance of the new entity will not be affected by the ups anddowns of the originating entity. The SPE will be subject to fewerrisks and thus provide greater comfort to the lenders. What isimportant here is the distance between the sponsoring company andthe SPE. In the absence of adequate distance between the sponsorand the new entity, the latter will not be an SPE but only asubsidiary company.

A good SPE should be able to stand on its feet, independent ofthe sponsoring company. Unfortunately, this does not always happenin practice. One of the reasons for the collapse of the Enron SPEwas that it became a vehicle for furthering the ends of the parentcompany in violation of the prudential norms of corporate financingand accounting.

Abuses

Special purpose entities were one of the main tools used byexecutives at Enron, in order to hide losses and fabricateearnings, resulting in the Enron scandal of 2001. They were alsoused to hide losses and overstate earnings by executives at TowerFinancial, which declared bankruptcy in 1994. Several executives ofthe company were found guilty of securities fraud, served prisonsentences, and paid fines.

Accounting guidance

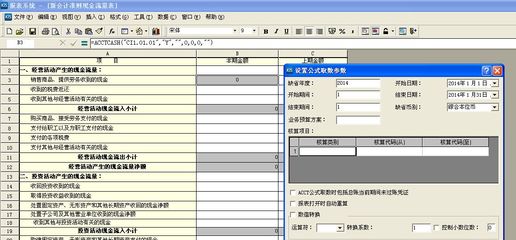

Under US GAAP, a number of accounting standards apply to SPEs,most notably FIN46R that sets out the consolidation treatment ofthese entities. There are a number of other standards that apply todifferent transactions with SPEs.

Under International Financial Reporting Standards (IFRS), therelevant standard is IAS 27 in connection with the interpretationof SIC12 (Consolidation—Special Purpose Entities). The IASBpublished an exposure draft (ED 10) to merge both regulations.

爱华网

爱华网