Chartists can use this indicator to affirm a security'sunderlying trend or anticipate reversals when the indicatordiverges from the securityprice.用来(1)确定潜在的趋势、(2)如果指标与价格背离时,用来预测反转

计算: 1. Money Flow Multiplier = [(Close- Low) - (High - Close)] /(High- Low) //权衡系数 2. Money Flow Volume = Money FlowMultiplier x Volume for the Period 3. ADL = Previous ADL + Current Period'sMoney Flow Volume

The Money Flow Multiplier fluctuates between +1 and-1.权衡系数在-1和+1之间浮动。As such, it holds the key to the Money Flow Volume and theAccumulation Distribution Line. The multiplier is positive when theclose is in the upper half of the high-low range and negative whenin the lower half.如果收盘价在最高价与最低价中间位置偏上,MoneyFlow Multiplier为正,反之为负。This makes perfect sense. Buying pressure is stronger thanselling pressure when prices close in the upper half of theperiod's range (and visa versa). The Accumulation Distribution Linerises when the multiplier is positive and falls when the multiplieris negative.

The multiplier is +1 when the close is onthe high and -1 when the close is on thelow.

理解:The Accumulation Distribution Line is a cumulative measure ofeach period's volume flow, or money flow. A high positivemultiplier combined with high volume shows strong buying pressurethat pushes the indicator higher. Conversely, a low negative numbercombined with high volume reflects strong selling pressure thatpushes the indicator lower.正的高的权衡系数与高成交量组合,表明买压很强,指数增加。负的低的权衡系数与高成交量组合,表明卖压很强,指数降低。Money Flow Volume accumulates to form aline that either confi rms or contradicts the underlying pricetrend. In this regard, the indicator is used to eitherreinforce the underlying trend or cast doubts on itssustainability.根据指数情况,可以加强对当前走势的确认,或者对其可持续性提出质疑。

An uptrend in prices with a downtrend in theAccumulation Distribution Line suggests underlying selling pressure(distribution) that could foreshadow a bearish reversal on theprice chart. A downtrend in prices with an uptrend in theAccumulation Distribution Line indicate underlying buying pressure(accumulation) that could foreshadow a bullish reversal inprices.价格向上,但指数向下暗示卖压积累,牛市反转。相反,价格向下,指数向上暗示买压积累,熊市反转。

ADL与OBV的对比:OBV指数,是比较当前收盘价与前期收盘价的关系,收盘价增加,则指数升高,反之亦然。而ADL不在乎不同时间的收盘价比较,而是关心收盘价在当前时间段与最低、最高价的相对位置。所以,OBV指数增加的时候,ADL可能减少。举个例子如下图:The Accumulation Distribution Line and On Balance Volume (OBV)are cumulative volume-based indicators that sometimes move inopposite directions because their basic formulas are different. JoeGranville developed On Balance Volume (OBV) as a cumulative measureof positive and negative volume flow. OBV adds a period's totalvolume when the close is up and subtracts it when the close isdown. A cumulative total of this positive and negative volume flowforms the OBV line. This line can then be compared with the pricechart of the underlying security to look for divergences orconfirmation.

As the formula above shows, Chaikin took a different approach bycompletely ignoring the change from one period to the next.Instead, the Accumulation Distribution Line focuses on the level ofthe close relative to the high-low range for a given period (day,week, month). With this formula, a security could gap down andclose significantly lower, but the Accumulation Distribution Linewould rise if the close were above the midpoint of the high-lowrange. The chart above shows Clorox (CLX) with a big gap down and aclose near the top of the day's high-low range. OBV moved sharplylower because the close was below the prior close. The AccumulationDistribution Line moved higher because the close was near the highof the day.

用法:(1)趋势确认Trend confirmation :Trend confirmation is a pretty straight-forward concept. Anuptrend in the Accumulation Distribution Line reinforces an uptrendon the price chart and visa versa. The chart below shows FreeportMcMoran (FCX) and the Accumulation Distribution Line advancing inFebruary-March, declining from April to June and then advancingfrom July to January. The Accumulation Distribution Line confirmedeach of these price trends.曲线与价格走势基本吻合,说明了趋势确认的相对合理性。

(2)背离:Bullish and bearish divergences are where it starts gettinginteresting. A bullish divergence forms when price moves to newlows, but the Accumulation Distribution Line does not confirm theselows and moves higher. A rising Accumulation Distribution Lineshows, well, accumulation. Think of this as basically stealth【秘密行动】buying pressure. Based on the theory that volume precedes price,chartists should be on alert for a bullish reversal on the pricechart.熊市背离:价格创新低,但指数增加,表明买压在积累。也可以理解为偷偷的买入。这时要警惕牛市的到来。

举例如下图:The chart above shows Nordstrom (JWN) with the AccumulationDistribution Line. Notice how it is easy to compare price actionwhen the indicator is placed "behind" the price plot. The indicator(pink) and the price trend moved in unison from February to June.Signs of accumulation emerged as the indicator bottomed in earlyJuly and started moving higher. JWN moved to a new low in lateAugust. Even though the indicator showed signs of buying pressure,it was important to wait for a bullish catalyst or confirmation onthe price chart. This catalyst came as the stock gapped up andsurged on big volume.图中绿色箭头处,指数有限见底回升。而蓝色箭头处,价格才见底。这时成交量优先于价格理论的体现。

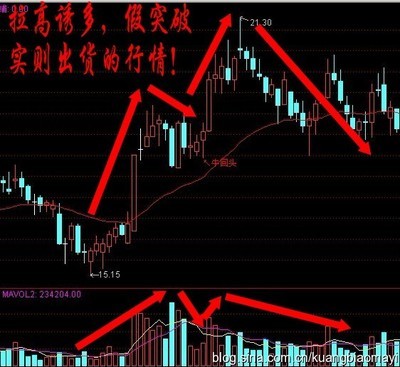

相反,熊市背离的情况是,价格创新高,但指数降低。A bearish divergence forms when price moves to new highs, butthe Accumulation Distribution Line does not confirm and moveslower. This shows distribution or underlying selling pressure thatcan foreshadow a bearish reversal on the price chart. 如下图

The chart above shows Southwest Airlines (LUV) with theAccumulation Distribution Line peaking two months ahead of prices.The indicator not only peaked, but it also moved lower in March andApril, which reflected some selling pressure. LUV confirmedweakness with a support break on the price chart and RSI movedbelow 40 shortly afterwards. RSI often trades in bull zones (40-80)and bear zones (20-60). RSI held in the bull zone until early Mayand then moved into a bear zone.【如何结合RSI使用?】

(3)Disconnect with Prices 【这时提醒,ADL可能造成误导】The Accumulation Distribution Line is an indicator based on aderivative of price and volume. This makes it at least two stepsremoved from the actual price of the underlying security.【没理解?】

Moreover, the Money Flow Multiplier does not take into accountprice changes from period to period.指数没有考虑不同时期的相对变化,也会导致无法正确给出信号的情形。As such, it cannot be expected to always affirm price actionor successfully predict price reversals with divergences. Sometimesthere is a, gasp, disconnect between prices and the indicator.Sometimes the Accumulation Distribution Line simply doesn't work.This is why it vitally important to use the AccumulationDistribution Line, and all indicators for that matter, inconjunction with price/trend analysis and/or otherindicators.有一个很严重误判的例子,如下图:

结论:The Accumulation Distribution Line can be used to gauge thegeneral flow of volume. An uptrend indicates that buying pressureis prevailing on a regular basis, while a downtrend indicates thatselling pressure is prevailing. Bullish and bearish divergencesserve as alerts for a potential reversal on the price chart. Aswith all indicators, it is important to use the AccumulationDistribution Line in conjunction with other aspects of technicalanalysis, such as momentum oscillators and chart patterns. It isnot a stand-alone indicator.建议与动能和图片模式等指标配合使用。

爱华网

爱华网