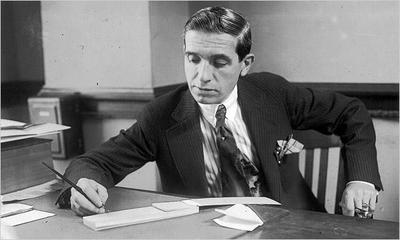

Bernard Madoff, history’s biggest swindler, faceslife behind bars

SURELY a drama thisdark deserved a more explosive finale. A previous wave of financialfraud produced many an entertaining courtroom battle, featuring thelikes of Enron’s Jeffrey Skilling and Tyco’s Dennis Kozlowski. ButBernard Madoff has robbed the world of such a catharsis, just as herobbed almost 5,000 credulous clients of billions of dollars. OnThursday March 12th he pleaded guilty in a Manhattan court to 11 charges, ranging from securities and mailfraud to money laundering and perjury. Together they carry amaximum jail term of 150 years, leaving the 70-year-old “MonsterMensch” all but certain to spend the rest of his life behindbars.

The fraud hemasterminded was remarkable for its scale, longevity and thesophistication of its victims: hedge-fund founders, Swiss banks andmovie moguls, as well as charities and small investors, some ofwhom put in their life savings. The charge sheet confirms that heran a Ponzi scheme of unprecedented boldness, dating at least asfar back as the 1980s. Mr. Madoff claimed to achieve healthy,stable returns through a whizzy stock- and options-tradingstrategy. In reality, there was no trading for well over a decade.Money from new investors was used to cover redemptions for oldones. It was that simple and brazen.

The fraud was biggerthan the $50 billion Mr. Madoff originally claimed to have lost. Onpaper, he had $65 billion in client accounts just before he wasarrested in December, say prosecutors, who are claiming aneye-popping $171 billion in restitution.

But there nowappears to be little left for investors who stuck with him: acourt-appointed liquidator has so far recovered just $1 billion.Even Charles Ponzi’s victims got a third of their moneyback.

Mr. Madoff’s guiltyplea is especially anticlimactic because he has apparently refusedto co-operate with investigators, leaving many a loose thread. Fewbelieve that he acted alone, but identifying those who colluded,and how, is proving difficult.

Friends andrelatives who helped to run the firm remain under scrutiny. Junioremployees were apparently made to generate fake trade confirmationsand monthly statements, though it is not clear if they knew theywere partaking in a fraud.

Mr. Madoff creamedoff commissions from his investment business to support hisshare-trading operations. But how much he kept for himself isanyone’s guess.

The drama hasseveral more acts. Those who channelled investors’ money to Mr.Madoff, such as his now notorious “feeder funds”, face years oflitigation as victims go after those with deep pockets.

Some conduits, suchas Santander, a Spanish bank, have already offered partialreimbursement. Lawyers are also targeting investors who withdrewtheir funds (plus fictional interest) before the fraudster’sarrest. Whether that includes the charity that withdrew $90m morethan it paid in remains to be seen.

Seething victims andpundits have variously denounced Mr. Madoff as a “terrorist”, a“financial serial killer” and, most cuttingly, a “turd”. For now,they will have to make do with seeing him locked up without thefireworks of a trial, still guarding his biggest secrets. To hopefor more may only court further disappointment.

Bernard Madoff,历史上最有名的骗子,将面临牢狱生活。

一部黑色的戏剧必然会有一个让人振奋的结局。前一阵子的金融诈骗狂潮已经将法庭闹得沸沸扬扬, 其中的代表人物有Enron’s Jeffrey Skilling、Tyco’s DennisKozlowski。但Bernard Madoff让那些案件显有些小巫见大巫了,他诈骗了5000名轻信他人的顾客数亿美圆。3月12日周四,他在Manhattan的一个法庭上对11项指控认罪,这些指控涉及了有价2,邮件诈骗,洗钱和作伪证。把这些指控全加起来的话,他将面临为期150年的牢狱生活,差一点就把这个70岁的“金融骗子”的余生全部葬送在铁窗之下了。

Madoff所一手策划的诈骗,以其所涉及的范围之广,持续时间之长,受害者类型之复杂而闻名:HEDGE基金的创立者,瑞典银行,电影名人和慈善集团,小型的投资者,其中有一些是挪用了他们毕生的积蓄去投资的。根据他的案件记录,Madoff这个胆大包天的庞氏诈骗计划至少可以追溯到20世纪80年代。他声称快速股票-股票预购买卖计划可以让投资者得到健康,稳定的回报。实际上,在这十年多来根本就没有交易。他用新投资者的钱去偿还老用户的债务。这种手法真的是又简单,又厚颜无耻。

欺诈金额要比Madoff原先声称已经损失的50亿美圆还要多。检举人说道:12月在他刚被捕之后不久,他书面的账簿就揭露了65亿美圆的客户资金。他同时还指出Madoff要归还一个惊人的数字1710亿美圆。

但是调查人员收获甚微:一名法庭指定的清算师到目前为止只复员了10亿美圆。而庞氏诈骗案的受害者们只得到了损失的三分之一的偿还。

Madoff的服罪显然是虎头蛇尾的,因为他已经很清楚地拒绝了与调查人员的合作,留下了许多的模糊线索。很少有人相信他是单独操作诈骗的,但是要查明他的同党的身份,以及怎么查是一个很大的难题。

帮助Madoff打理公司的他的亲朋好友现在仍在严密的监视之下。虽然现在还不清楚这些高级职员是否参与了诈骗,但很显然,Madoff让他们签署了贸易合同和每月的报表。

愤怒的受害者和学者们纷纷谴责Madoff是一个“经济恐怖分子”,一个“金融连环杀手”,和最最可憎的“粪“。到目前为止,Madoff都没有对审判提出任何的异议,呆在铁窗之后保守着他最大的秘密。案件调查越是深入,也许只会越加地让人失望。

好戏总有几个高潮。Madoff用投资者的钱创立的那些项目,如目前臭名昭著的“feeder基金”,随着受害者的追讨加剧,他正面临着数年的诉讼。

某些公司,如西班牙银行Santander,已经提供了部分偿还款项。律师们也将目标锁顶在那些在诈骗犯被捕之前就钱撤回的投资者。我们仍旧能这些目标中看到慈善机构,它是否已经撤回了多于它曾支付的90亿美圆还是个猜测。

Madoff从他的投资事业中精心挑选了数项资金项目去支持他的部分股票预购买卖计划。但是他究竟投入了多少还只是一个未知数。

爱华网

爱华网