小编为大家整理了银行开立信用证会话,希望对你有帮助哦!

第一篇:L/C(信用证)

C= Customer顾客 T=Teller职员

T: Can I help you, sir?

能帮你什么忙吗,先生?

C: Yes, I want to open an L/C, but I don't know how to work?

对, 我想开个信用正, 但我不明白如何运作?

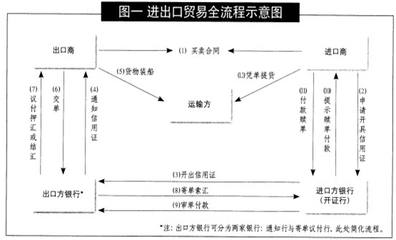

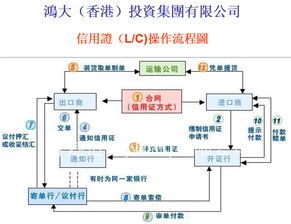

T: Ok, Let tell you. A letter of credit is a written payment instrument issued by a bank at the request of a customer (always the importer). It will be sent to the exporter to make shipment and prepare the documents specified in the L/C. As soon as the L/C and documents are presented to the issuing bank, the bank must pay to the exporter (beneficiary). The bank acts as the first payer and this is the most important feature of L/C.

好, 让我来告诉你。 信用正是应客户(通常是进口商)的要求而开立的一种付款承诺文件,信用证将被寄给出口商,使出口商可以把货物装船, 并根据信用正的要求准备单据。一旦信用证和单据提交给开证行,开证行必须立即付款给出口商(受益人)。银行就作为第一支付人进行支付,这就是信用证最重要的特征。

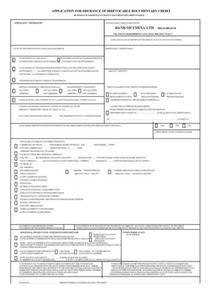

C: I see, would you tell me what's the main content of an L/C?

我明白了, 你能告诉我信用证的主要内容吗?

T: Name, quality, unit price and amount of goods, ports of loading and destination, price and payment terms, shipping documents, latest shipment date and validity of the L/C.

商品的品名,数量,单价和种类, 装货港和目的地,价格和付款条件,装船单据,最后装运期和到目的地的有效期。

C: Then how can I send an L/C to my customer?

那么, 我怎么才可以向我的客户开出信用证呢?

T: In practice, the issuing bank will send the L/C to one of its correspondents at the place of export by mail of cable. After verifying the authenticity of the L/C, the correspondent (advising bank) will send the L/C to the exporter.

习惯上,开证行总是向出口商所在地的代理行发出邮件或电报,在检验信用证的真实性后,代理行(通知行)将向出口方发出信用证。

C: How can my customer receive the proceeds?

我的客户怎样才能收到钱?

T: The exporter will make shipment and present the L/C with all the documents to a negotiation bank if it is available by negotiation. If the documents are in compliance with the terms of the L/C through carefully checking, the bank will negotiate the documents and send them to the issuing bank for reimbursement. The issuing bank will debit importer's account when releasing the shipping documents to the importer. The whole transaction now comes to the end.

信用证是可以议付的,出口商向议付行提交信用证所要的所有单据, 只要所提交的单据和信用证要求的条件是一致的话,银行将议付。当开证行将装船单据交给进口商时,开证行就借记进口方的帐户,整个交易就完成了。

C: I see, Thank you very much

我明白了,谢谢你!

T: you're welcome!

别客气

第二篇:L/C(信用证)

C= Customer顾客 T=Teller职员

T: Can I help you, sir?

能帮你什么忙吗,先生?

C: Yes, I want to open an L/C, but I don't know how to work?

对, 我想开个信用正, 但我不明白如何运作?

T: Ok, Let tell you. A letter of credit is a written payment instrument issued by a bank at the request of a customer (always the importer). It will be sent to the exporter to make shipment and prepare the documents specified in the L/C. As soon as the L/C and documents are presented to the issuing bank, the bank must pay to the exporter (beneficiary). The bank acts as the first payer and this is the most important feature of L/C.

好, 让我来告诉你。 信用正是应客户(通常是进口商)的要求而开立的一种付款承诺文件,信用证将被寄给出口商,使出口商可以把货物装船, 并根据信用正的要求准备单据。一旦信用证和单据提交给开证行,开证行必须立即付款给出口商(受益人)。银行就作为第一支付人进行支付,这就是信用证最重要的特征。

C: I see, would you tell me what's the main content of an L/C?

我明白了, 你能告诉我信用证的主要内容吗?

T: Name, quality, unit price and amount of goods, ports of loading and destination, price and payment terms, shipping documents, latest shipment date and validity of the L/C.

商品的品名,数量,单价和种类, 装货港和目的地,价格和付款条件,装船单据,最后装运期和到目的地的有效期。

C: Then how can I send an L/C to my customer?

那么, 我怎么才可以向我的客户开出信用证呢?

T: In practice, the issuing bank will send the L/C to one of its correspondents at the place of export by mail of cable. After verifying the authenticity of the L/C, the correspondent (advising bank) will send the L/C to the exporter.

习惯上,开证行总是向出口商所在地的代理行发出邮件或电报,在检验信用证的真实性后,代理行(通知行)将向出口方发出信用证。

C: How can my customer receive the proceeds?

我的客户怎样才能收到钱?

T: The exporter will make shipment and present the L/C with all the documents to a negotiation bank if it is available by negotiation. If the documents are in compliance with the terms of the L/C through carefully checking, the bank will negotiate the documents and send them to the issuing bank for reimbursement. The issuing bank will debit importer's account when releasing the shipping documents to the importer. The whole transaction now comes to the end.

信用证是可以议付的,出口商向议付行提交信用证所要的所有单据, 只要所提交的单据和信用证要求的条件是一致的话,银行将议付。当开证行将装船单据交给进口商时,开证行就借记进口方的帐户,整个交易就完成了。

C: I see, Thank you very much

我明白了,谢谢你!

T: you're welcome!

别客气.

爱华网

爱华网