Contents

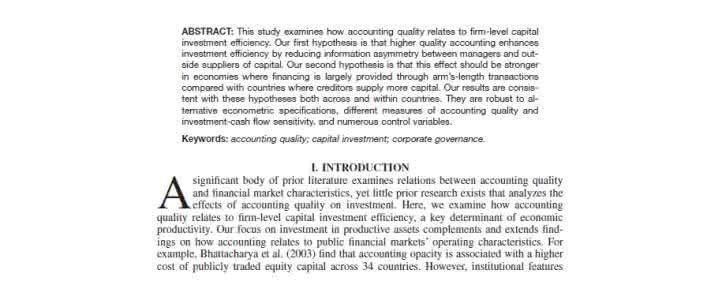

Abstract………………………………………………………………………………I Introduction…………………………………………………………………………Ⅱ Efficient Accounting Systems………………………………………………………1 Chapter 1 Accounting ………………………………………………………………1

1.1 The decision of accounting ………………………………………………………2

1.2 The functions of accounting………………………………………………………4 Chapter 2 Accounting environment…………………………………………………7

2.1 The goal of accountant is the starting point in which accounting environment affects the accounting information system……………………………………………9

2.2 Accounting assumed reveals close link between accounting and its interdependent external environment…………………………………………………………………10

2.3 Accounting standards disclose the request of accounting environment to accounting information………………………………………………………………13 Chapter 3 Accounting system………………………………………………………15 Conclusion …………………………………………………………………………30 References …………………………………………………………………………31 Thanks………………………………………………………………………………32

Efficient Accounting Systems

The existence and development of everything are under certain environmental conditions. Accounting, as one of the most important practice of human activities is not a cases outside. Accounting environment have the base sense for the smooth conduct of the activities of accounting, while various accounting environmental factors will have isolated impact on total activity of the accounting system. The study of the structure of the accounting environment system and the relations between the various elements in this system made us to be much more realistic in this area of accounting theory and practice, to build a harmonious Environmental System for clear direction, so as to promote the accounting cause of sustainable development. Chapter 1 Accounting

1.1 The decision of accounting

Accounting is one of the fastest growing fields in the modern business world. Every new shore, school, restaurant, or filling station indeed, any new enterprise of any kind increases the demand for accountants. Consequently, the demand for accountants is generally much greater than the supply. Government official often have a legal background: similarly, the men and women in management often have a background in accounting. They are usually familiar with the methodology of finance and fundamentals of fiscal and business administration.

Today’s accountants are as diverse as their job assignments. Accountants may be male or female, outgoing or conservative, but they are all analytical. They may have backgrounds in art history or computer programming. They come from every ethnic and cultural background.

The accounting backgrounds can open doors to most lines of business. In short, accounting deals with all facets of an organization —purchasing, manufacturing, marketing, and distribution. This is why accounting provides such an excellent basis for business experience. Accounting is an information system necessitated by the

great complexity of modern business.

1.2 The functions of accounting

One of the most important functions of accounting is to accumulate and report financial information that shows an organization’s financial position and the results of its operations to its interested users. These users include managers, stockholders, banks and other creditors, governmental agencies, investment advisors, and the general public. For example, stockholders must have an organization’s financial information in order to measure its management’s performance and to evaluate their own holdings. Banks and other creditors must consider the financial strength of a business before permitting it to borrow funds. Potential investors need financial data in order to compare prospective investments. Also many laws require that extensive financial information be reported to the various levels of government. Businesses usually publish such reports at least annually. To meet the needs of the external users, a framework of accounting standards, principles and procedures known as ―generally accepted accounting principles‖ have been developed to insure the relevance and reliability of the accounting information contained in these external financial reports. The subdivision of the accounting process that produces these external reports is referred to as financial accounting.

Another important function of accounting is to provide the management inside an organization with the accounting information needed in the organization’s internal decision-making, which relates to planning, control, and evaluation within an organization. For example, budgets are prepared under the directions of a company’s controller on an annual basis and express the desires and goals of the company’s management. A performance report is supplied to help a manager focus his attention on problems or opportunities that might otherwise go unnoticed. Furthermore, cost-benefit data will be needed by a company’s management in deciding among the alternatives of reducing prices, increasing advertising, or doing both in attempt to maintain its market shares. The process of generating and analyzing such accounting information for internal decision –making is often referred to as managerial

accounting and the related information reports being prepared are called internal management reports. As contrasted with financial accounting, a management accounting information system provides both historical and estimated information that is relevant to the specific plans on more frequent basis. And managerial accounting is not governed by generally accepted accounting principles.

Chapter 2 Accounting environment

The growth of organizations, changes in technology, government regulation, and the globalization of economy during the twentieth century have spurred the development of accounting. As a result, a number of specialized fields of accounting have evolved in addition to financial accounting and managerial accounting, which include auditing, cost accounting, tax accounting, budgetary accounting, governmental and not –for-profit accounting, human resources accounting, environmental accounting, social accounting, international accounting, etc. For example, tax accounting encompasses the preparation of tax returns and the consideration of the tax consequences of proposed business transactions or alternative courses of action. Governmental and not-for-profit accounting specializes in recording and reporting the transactions of various governmental units and other not-for-profit organizations. International accounting is concerned with the special problems associated with the international trade of multinational business organizations. All forms of accounting, in the end, provide information to the related users and help them make decisions.

Accountant the environment has, the development closely with accountant related, and decided that accountant the thought that the accounting theory, accountant organize, accountant the legal system as well as the accountancy level of development historic condition and the particular case.

Studies accountant the environment the influence which develops to accountant, should take accountant the goal, accountant suppose, the accounting standards as the clue.

2.1 The goal of accountant is the starting point in which accounting environment

affects the accounting information system

Each kind of accountant under the pattern accountant the goal concrete difference may sum up as accountant the environment different result. Looking from longitudinal, the different historical period, accountant the environment is different, accountant the goal is also different, from this causes the accounting information existence huge difference; Looking from crosswise, different national accountant the environment is different, accountant the goal content has the difference, its accounting information is also unique. About accountant the goal, the theorists have ―the policy-making useful view‖ and ―the management responsibility view‖ the struggle. What policy-making useful view interdependence is the developed capital market, the resources request and is entrusted with something the relations are establishes through the capital market. Thus, the resources entrusting party and is entrusted with something the side responsibility relations intermediary becomes because of the capital market fuzzy. But the responsibility view to base the resources request which forms in the direct intercourse with is entrusted with something the relations. Western various countries and the international accounting standards committee approve the policy-making useful view. If the international accounting standards committee said that ―must focus the attention to provide to the economic decision-making useful information‖. Comparatively speaking, the management responsibility view depends on each other accountant the environment and the Chinese present stage economic reform and the development actual situation even more tallies. The current our country financial inventory accounting's essential target, should locate, in approaches the trustee to report the fiduciary duty in the fulfillment situation. Because of from the time, the management responsibility view mainly faces the future, but faces in the past and the present. But in accountant confirmed that the standard and the measurement foundation's choices aspect, the foothold in the past and the present must be easier than in the future the foothold, provided the information quality even more drew close to the goal the request.

Because just accountant the goal affects the accounting information system's basic reason, therefore, the environment embarks from accountant to accountant the

goal locates, can cause the accounting theory to move toward the accounting practice from Yu the accounting practice.

2.2 accountants supposed has promulgated accountant between the external environment close relations which depended on each other with it.

Accountant supposes is the accounting personnel the reasonable judgment which locates to the accounting the change which does not decide accountant who the environment makes, is the accounting basic premise Accountant supposes to financial inventory accounting has the overall importance influence, it is the behavior main body and the general situation embarks from accountant constructs the system info, American Accounting standards Committee Respective Accountant Research department's first memoir is ―accountant's fundamental assumption‖. Although theoretically speaking, the sound value information will have the guidance compared to the historical costs information regarding the user future economic decision-making, just like but US Chartered accountant the Association financial report Technical committee will publish the topic will be "Improvement Enterprise Reported that - - Customer Guidance" said that the numerous users did not advocate by the sound value pattern substitution historical costs pattern, its reason will mainly be stems from the guarantee financial report information consistency, reliable and the cost - benefit principle consideration. However, they advocate many kinds of measurement attribute mix valuation.

Accountant supposes is based on the external environment uncertainty proposed that therefore, may say that accountant supposes is the accounting theory and accountant the environment connected border meeting point, depends on each other accountant with it the environment to have the extremely close relationship.

2.3 The accounting standards disclose accountant the environment to the accounting information request

Accountant the environment to accounting standards' influence, may manifest in the accounting standards technical nature, the social two aspects.

1. Technical nature. The accounting standards were considered that is one kind of pure objective restraint organization, one merely technical's standard method, its

goal is enables accounting practice processing the science, to be reasonable, to be consistent. Since produces the behavior has universal restraint accountant after accountant the standard system, accountant reforms mainly displays in accountant the standard system's reform, but accountant standard system's reform, displays for concrete accountant the computing technique innovation.

2. Sociality. The different accounting standards will have the different accounting information, thus affects the different main body benefit, it will cause part of people to profit, but another part of people possibly suffer injury. The accounting standards produce the economic consequences prove its and impure objective. Accounting standards' sociality materially is the economic interest question, immediate influence to economic interest between related various aspects assignment. One of market economy's base elements is the fair competition;All market economy participants cannot different form the rank difference because of the right status. If the administrative right trades the behavior with the market economy to unify in together, will destroy the market mechanism, will be unable to realize the market economy effective disposition resources function. Therefore accounting standards' formulation organization must be the neutral organization, guarantees the accounting standards fairness and the rationality.

Chapter 3 Accounting System

Accounting system refers to establish accounting and accounting supervision procedure and method of business activities. Effective accounting system should do:

1. Confirmed and record all real business, timely and detailed description of economic business, so in the financial and accounting reports of economic business appropriately classified.

2. Measurement value of economic business, so in the financial and accounting reports records in the appropriate monetary value.

3. Determine the time, business to business records in the appropriate accounting period.

4. In the financial and accounting reports, business and proper disclosure of expression related matters.

有效会计体系

任何事物都是在一定的环境条件下存在和发展的, 作为人类重要实践活动之一的会计活动也不例外。会计环境对于会计各项活动的顺利展开具有基础意义, 同时各个会计环境因素并不是孤立地对会计活动产生影响, 研究会计环境体系的结构以及体系中各个要素之间的相互关系能够使我们在会计理论与实务领域更好地做到实事求是, 为构建和谐会计环境体系明确方向, 从而促进会计事业的可持续发展。

第一章 会计

1.1 会计的概述

今天的会计师是多种多样的,因为他们的工作任务不同。会计师可能是男性或女性,激进或保守,但他们都具有分析能力。他们有的也许拥有艺术或电脑编程的背景,有的也许拥有不同的种族和文化背景。

拥有会计的背景可以打开很多不同企业的大门。简言之,会计涉及到企业的所有层面——采购、制造、营销和分配。这就是为什么会计能为从商经验提供了这们一个良好基础的原因。会计是由于现代企业的巨大复杂性而成为必要的信息系统。

1.2 会计的职能

会计的最重要职能之一是向有利害关系的使用者累积和报告有关某一组织的财务状况和经营成果的财务信息。这些使用者包括经理人员、股东、银行和其他债权人、政府机构、投资顾问,以及广大公众。例如,股东为了衡量管理当局的业绩和评价本人拥有的股份,必须取得财务信息:银行及其他债权人在允许企业贷款之前,必须考察这家企业的财务实力;潜在投资者需要利用财务信息对预期的投资进行比较。同样,许多国家的法律都要求企业向各级政府报告广泛的财务信息。企业通常至少每年地公布这类财务报告。为了满足报告使用者的需求,为此,美国制定了一套包括会计准则、会计原则和会计程序的框架即“公认会计原则”,以保证这些对外报告提供的财务信息具有相关性和可靠性。会计过程中形成这类对外报告的分支,称为财务会计。

会计的另一个重要职能是向某一组织的管理当局提供该组织内部决策所需的会计信息,这些决策包括某一组织内的计划、控制和评价。例如,由公司总会计师指导编制的年度预算阐明公司管理当局的意愿与目标。业绩报告有助于经理人员把注意力集中于那些可能被忽视的问题或机遇。成本—效益数据则能够帮助公司管理当局对诸如减低价格、增加广告费用、或同时减低价格和增加广告费用以保持市场份额等多种选择方案进行决策。形成和分析这种用于内部决策的会计信息的程序通常称为管理会计,其所提供的信息报告称为内部管理报告。与财务会计不同,管理会计信息系统在更加频繁基础上同时提供与具体计划相关的历史信息和预测信息。而且,管理会计不受公认会计原则的约束。

二十世纪中各类组织的增长、技术革新、政府监管以及经济全球化都推动了会计的发展。从而出现一系列除财务会计和管理会计以外的会计新领域:审计,

成本会计,税务会计,预算会计,政府用非赢利组织会计,人力资源会计,环境会计,社会会计,国际会计,等等。例如,税务会计涉及纳税申报单的编制以及研究经济业务或不同措施可能产生的纳税影响,政府及非营利组织会计专注于记录和报告不同政府部门和其他非营利组织的经济业务。国际会计研究跨国公司在国际贸易过程中遇到的特殊会计问题。总之,任何会计的目的都是为了向使用者提供有助于他们决策的信息。

众所周知,财务会计确认、计量和记录的目的是向外界提供真实有用的财务报告,最新的财务报告应揭示对报告运用者决策最相关的全部信息,即关于会计主体未来现金流量时机、金额、不确定性的信息。财务报告的核心是财务报表,通过财务报表向信息运用者提供对决策有用的信息。但在传统财务报表中,往往存在如下局限性:首先,传统财务报表有固定的格式、固定的填列方式及项目,对金融衍生工具等特殊业务往往无法反映;其次是传统财务报表以历史成本为基础提供信息,导致市场价格波动剧烈的金融衍生工具难以准确披露;县后是传统财务报表仅记录可以用货币予以量化的信息,金融衍生工具由于其本身特征,往往难以准确估计未来金额,故在会计报表中披露也有一定困难。由于以上原因,金融衍生工具不能在该财务报表中得以反映,而只能作为表外业务,在表外作附往说明,投资者甚至是企业高层决策者也无法从财务报表上直接了解金融衍生工具的风险状况。但在现实生活中,金融衍生工具交易额十分巨大,交易十分复杂,其作为表外业务风险的隐蔽性潜伏着巨大风险的危机,对任何一个会计主体而言都不可等闲视之。但由于其不完全符合会计要素定义和标准,而只能在表外列示。这使得投资者无法依据传统财务报表估计和判断其风险和报酬,成为经济决策中的严重障碍。

第二章 会计环境 会计环境是与会计产生、发展密切相关,并决定会计思想、会计理论、会计组织、会计法制以及会计工作发展水平的历史条件及特定情况。研究会计环境对会计发展的影响,应以会计目标、会计假定、会计准则为线索。

2.1 会计目标是会计环境作用于会计信息系统的出发点

各种会计模式下会计目标的具体差别可归结为会计环境不同所致。从纵向来看,不同历史时期,会计环境不同,会计目标也不同,由此导致会计信息存在

巨大差异;从横向来看,不同国家会计环境不同,会计目标的内容存在着差异,其会计信息也各具特色。关于会计目标,理论界有―决策有用观‖和―经营责任观‖之争。决策有用观依存的是发达的资本市场,资源的委托和受托关系是通过资本市场建立起来的。这样,资源的委托方和受托方的责任关系因资本市场的中介而变得模糊起来。而经营责任观立足于直接往来形成的资源的委托与受托关系。西方各国和国际会计准则委员会都认可决策有用观。如国际会计准则委员会所说,―要集中注意力于为了提供对经济决策有用的信息‖。比较而言,经营责任观所依存的会计环境与中国现阶段经济改革和发展的实际情况更加吻合。当前我国财务会计的主要目标,应定位在向委托人报告受托责任的履行情况上。因为从时间上看,经营责任观主要不是面向未来,而是面向过去和现在。而在会计确认标准和计量基础的取舍方面,立足过去和现在要比立足未来更加容易,所提供的信息质量更加贴近目标的要求。

正因为会计目标是影响会计信息系统的根本原因,因此,从会计环境出发对会计目标加以定位,才能使会计理论来自于会计实践又走向会计实践。

2.2 会计假定揭示了会计同它依存的外部环境之间的密切联系

会计假定是会计人员对会计核算所处的变化不定的会计环境做出的合理判断,是会计核算的基本前提。会计假定对财务会计具有全局性的影响,它是从会计行为的主体和大局出发来构建理论体系,美国会计准则委员会所属会计研究部的第一号研究报告就是―会计的基本假定‖。尽管从理论上讲,公允价值信息比历史成本信息对于使用者未来的经济决策更具指导性,但正如美国注册会计师协会财务报告专门委员会发表的题为《改进企业报告——顾客导向》所说,众多使用者并不主张以公允价值模式替代历史成本模式,其理由主要是出于保证财务报告信息的一贯性、可靠性和成本-效益原则的考虑。不过,他们主张多种计量属性混合计价。

会计假定是基于外部环境的不确定性而提出的,因此,可以说会计假定是会计理论与会计环境相连的交界点,同它所依存的会计环境有极为密切的关系。

2.3 会计准则披露会计环境对会计信息的要求

会计环境对会计准则的影响,可以体现在会计准则的技术性、社会性两个方面。

1.技术性。会计准则被认为是一种纯客观的约束机构,一种纯技术的规范手段,其目的是使会计实务处理能够科学、合理、一致。自从产生对会计行为具有普遍约束的会计规范体系之后,会计改革主要表现在会计规范体系的改革,而会计规范体系的改革,就表现为具体会计技术方法的革新。

2.社会性。不同的会计准则将产生不同的会计信息,从而影响到不同主体的利益,它将使一部分人受益,而另一部分人可能受损。会计准则产生的经济后果证明其并非纯客观的。会计准则的社会性实质上是经济利益问题,直接影响到经济利益在有关各方面之间的分配。市场经济的基本要素之一是公平竞争,一切市场经济参与者都不能因为权利地位不同而形成等级差别。行政权利如果同市场经济中交易行为结合在一起,就会破坏市场机制,无法实现市场经济有效配置资源的功能。所以会计准则的制定机构必须是中立机构,以保证会计准则的公平性与合理性。

第三章 会计制度

会计制度是指建立会计核算和监督的程序和业务活动的方法。有效的会计制度应做的:

1、确认并记录所有真实的业务,及时和经济业务的详细说明,将金融和经济业务会计报告适当归类。

2、计量经济业务的价值,在财务会计报告中适当的货币价值的记录。

3、确定企业在适当的会计期间的业务记录的。此外,在财务会计报告,业务及表达适当地披露有关事宜。

百度搜索“爱华网”,专业资料,生活学习,尽在爱华网

爱华网

爱华网