How to reduce finance charges without the usual borrowings?如何不借款,减少财政经费?A business operator in ZheJiang wanted us to invest RMB $30 million to buy a piece of land to expand his business. We did not take up his offer because our workings show that the cash flow and earnings cannot justify the acquisition of the land. His reason was that although the workings may not justify the acquisition, he felt that the capital gain would be very attractive. He has observed that many companies make money from such land speculation. We explained to him that we are investors not speculators or gamblers.浙江一家企业的老板希望我们投资3000万来买一块地皮,扩大其生产业务。我们没有接受他的提议,因为我们的调查数据显示现金流和所得收入与购买这块地不相适合。浙江老板的理由是尽管数据与收购土地不符合, 但他觉得资金回报是很可观的,而且他发现许多公司从投机土地中赚了不少的钱。 我们解释说我们是投资者而不是投机者或是赌徒。

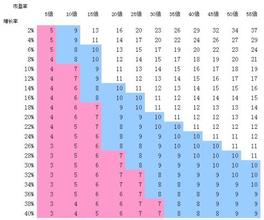

aihuau.comThe company went on to raise RMB $30 million through loans paying nearly 10% interests per year. The company’s earnings were $5 million and the interest the company had to pay was $3 million per year. Earnings suffered and declined to $2 million. The larger piece of land required more operating expenses to maintain but revenue increased marginally by 20%. It was clearly “sunbathing” the land to wait for capital appreciation.但该公司坚持借款筹集到3000万人民币,每年支付10%的利息。公司的盈利是500万,而每年支付的利息是300万,盈利扣除利息后只剩200万。这么大一块地需要高额运营费用来维护,而每年的收入只增加了20%。很明显,地皮“晒着太阳”等着升值。From the investors’ perspective, the company was over geared with a capital of only RMB $5 million. It borrowed 6 times its capital and used 60% of its earnings to service the debt’s interest. This was highly risky and failed the prudence test. No responsible professional managers would make a company take on such debts and risks.从投资人的角度来看,公司只有500万人民币的资本,其借款金额高达资本的6倍,还用盈利的60%去偿还借款利息,这样风险太高,不符合谨慎原则。只有不负责的经理人才会让公司承担这么高的债务和风险。What the business operator had done was increase the company’s liabilities with a $30 million debt and a $3 million interest charge that brought the company’s net worth down considerably. Suppose this was a public company with a PER (price earning ratio) of say 10, such an act would make the company lost $30 million market capitalization with such move. 看看经营者做了些什么,他让公司背负了3000万元的借款,也就是说,增加了3000万元的负债,还要为此承担每年300万的利息支出,从而导致公司的净资大幅缩水。假设这是一家上市公司,市盈率(股价÷每股盈余)为10倍,那么这样的举措将使公司市值损失3000万。Conversely, if the investment was worthy, the company should not borrow the money to expand. Managers should first attempt to raise capital to fund expansion. Capital infusion strengthens the company; debts make the balance sheet looks terrible. You do not pay interests for capital. You pay pidends only when the company makes money. Interests are expenses, which must be paid regardless the company made money or not and they affect earnings. Earnings impact your market capitalization – that is your shareholders’ net worth. If your act make shareholders’ net worth diminish, they would diminish your company too by selling you short. It is as simple as that. You make them rich, they support you. Companies need the support of shareholders and their demand for your shares. The greater their demand, the higher your market capitalization and this lures big time fund managers to buy up your shares or take up your new shares. This way, you would have more capital to make your company stronger and expand effectively. What are you doing to get rid of loans, interest charges and to lure capital injection?相反的,如果投资是值得的,公司不应该借款来扩展业务。经理人应首先筹集到资金来扩充资本。资本注入会增加公司实力;借款会让资产负债表难看。您不需为资本支付利息。您只需在公司盈利时,支付红利。利息是费用,不管公司盈利与否,都需要支付的,利息会影响到盈余,而盈余又会影响到您的市值——那是您股东的净值。如果您让股东们的净值缩水,他们会卖空,让您的公司也变小,就那么简单。您为他们赚了钱,他们就支持您。公司需要股东们的支持,股东也需要公司的股份。他们对股份需求越高,公司的市值就越高,这就会吸引更多出色的基金经理来买进公司股票或认购您的新股。通过这种方式,您将有更多的资本来把公司做大、做强。您如何摆脱借款、利息支出?并怎样吸引资本注入呢?

爱华网

爱华网